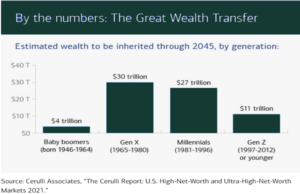

Client retention for both institutional and retail clients is taking center stage in all facets of financial services. On the retail side, generational wealth transfer through 2045 of over $72 trillion USD to younger generations is on track to disrupt the industry (source: Merrill Lynch). Firms are fully cognizant ‘re-winning’ the business with inheritors is essential to retaining assets under management (AUM). The digital and e-tools adopted for client relationship management during Covid increased the ease with which clients could decide to port their book of business to another firm. Competitive fee structures (including fully-paid lending programs), diversification of product offerings, focus on ESG, target-date funds and more sophisticated reporting are key drivers in achieving retail client retention.

For the more established, ultra-high network clientele firms are offering fully-paid lending programs (FPL) to keep clients assets sticky. In FPL programs, firms offer to establish securities lending agreements with them to enable clients to directly participate in revenue streams for securities in their portfolio that are on loan to other industry players. While the lending of securities by large institutions is not new, historically the revenue from that consolidated securities lending across all client and corporate portfolios was afforded to the deal-making firm, not its underlying clients. FPL is becoming a stronger tool in the client retention arsenal. While firms are widely promoting programs such as target-date funds, very little public marketing is offered on FPL program offerings but that will change over time as client retention stakes become higher amongst peers and competitors. While FPL is working well for more seasoned clientele and established portfolios, it’s success with younger wealth clients is still struggling as a result of securities held and volume compared to their parental counterparts who generally have stronger portfolios of the lendable, ‘blue chip’ type stocks.

While FPL is not a strong future play for younger generations yet, as firms look to equip themselves with technology and product offerings going forward, they need to identify the preferences of their Boomer clientele to the Gen X, Millennials and Gen Z who will inherit wealth from previous generations. The attraction of target-date funds by younger generations is taking center stage with firms transitioning from more passive products to more glide-path offerings. In addition to looking for different products, Gen X onwards are more tech savvy than their parents and grandparents and this is reflected in the importance of web-based tools and a transition to ease of navigability for sophisticated reporting access, trading and instruction capability and an overall trend to move away from paper. Cloud-based infrastructure and fully functioning apps for cell phone with 2-factor security are quickly becoming a decisive factor in client retention for younger generations.

Rimes has technology and data lakehouse capabilities in key areas firms are adopting for functionality and for the data availability and retention strategies, and particularly target-date funds handling. As many firms see target-date funds as a driver to keep younger generations investment goals within their asset mix, Rimes is helping with automated asset-allocation, modeling/rebalancing capabilities and exposure analysis to optimize the administration and transparent reporting of these structures to the satisfaction of portfolio managers and asset owners alike.

Similarly, Rimes ESG sophisticated drill-down management and analysis abilities are enabling constituent, portfolio and consolidated exposure management agile and transparent to support stronger reporting for ESG-minded clients.

As Rimes’ clients continue to evolve to retain clients with demands from us for more platform capabilities that offer strong value proposition and optimization synergies to enable successful client retention, Rimes will continue to strive for offerings to assist in those endeavors as the industry goes through the great wealth migration in the coming years.