The evolution of target data funds (TDFs) comes as the latest step from the birth of mutual funds in the 1990s and its expansion into exchange-traded funds (ETFs). These types of vehicles are not new, have grown steadily since inception, and in recent years exponentially for investment and complexity. Longer life expectancies, baby boomers edging towards their golden years and regulatory pressure on pension-type structures for workers have all contributed to birth and growth of these vehicles. What pressures do these products – and TDFs in particular – face today that is causing firms to retrofit their asset allocation capabilities to better support these investment vehicles?

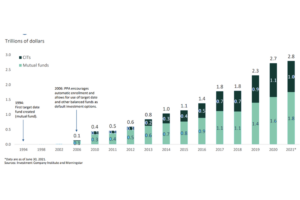

According to analysis done in 2022 by the Investment Company Institute, the percentage of 401(k)s participants invested in target-date funds grew from about 25% in 2007 to almost 60% by the early 2020. Concurrently, while the trend started before Covid, the industry has experienced increasing mutual fund redemption and stronger investment in exchange-traded funds (ETFs) during the last five years. As the demand for passive funds such as mutual funds in particularly that typically mirror an index are slowing, the demand for ‘set and forget’ TDF structures is growing.

The challenge for many existing buy-side firms is the technology stacks supporting passive index funds in firms are not as well equipped to handle the capabilities demand to support robust TDFs structures . Passive index funds rely heavily on rebalancing and are rigid in their underlying index. TDFs are constructed with a specific retirement or end date in mind and the asset allocation does the heavy lifting to adjust their assets over time from aggressive to more conservative as the individual nears retirement. The former approach is a more manual approach to ‘know your client’ (KYC) investing needs while TDFs take a more agile KYC approach to the risk profile evolution rely more heavily automation of the asset mix and asset allocation of a glide path rather than mirroring index returns. Retrofitting to accommodate agile asset allocation for retail-type accounts to hold TDFs presents additional challenges.

The level of sophistication with which investors are scrutinizing their fund choices has them looking at three key factors: rates of return, expense ratios and suitability. It’s a delicate balance for most firms to investment in technology to support competitive TDF offerings if there costs for offering them are out of control. In addition to technology stack challenges, offering competitive asset mix types in funds creates increased cost. Expense ratios for vanilla-type funds are averaging less than 1%, while more exotic alternative investments can be significantly higher, as much as double digit expense ratios. Firms are looking to automate their fund operations and ongoing asset allocation, rebalancing and exposure analysis as much as possible without creating undue KYC risk while simultaneously reducing cost – finding the balance between an asset mix offering that is a competitive product with attractive rates of return while keeping expense ratios in check is causing many firms to recalibrate their product offerings, benchmarks and automate ongoing costs and has become the holy grail as firms look to expand market share.

Rimes’ data and platforms are being selected by clients as part of this recalibration to remain competitive as the growth of glide-path investing continues. The four key factors attracting buy-side firms to Rimes for asset allocation, rebalancing and exposure analysis going forward also represent trends we are seeing in the industry:

- An asset agnostic platform to enable alternative assets on a consolidated basis as part of the TDF and glide path journey;

- Cost effective platform and data as the backbone to help reduce end-to-end operational costs and expense ratios;

- The capability to look at funds-of-funds-of funds exposure on an agile basis to ensure complex tree structures for exposure analysis at a consolidated or individual portfolio level;

- Decoupling trade execution from heavy lifting of front office needs for portfolio management and investment in specialized, sophisticated asset allocation platforms to handle glide path needs;

- Can pair with ESG capabilities for data and functionality to further enhance offerings to

- The capacity to ‘plug n’ play’ with new benchmarks to explore potential higher rates of return at lower or similar costs of quality data;

- Work with a market leader in assembling blended benchmarks to further enhance ROR attractiveness.

While the growth from mutual funds to ETFs to TDFs over the last three decades has been driven by longevity and boomer retirement planning, younger generations are gravitating to TDFs so interest and growth in these products with glide paths is anticipated to grow with key dates of 2040, 2050 and 2060 as the industry moves forward.